My 1979 T310R is equipped with a Shadin fuel totalizer which—like my fuel gauges—is calibrated in pounds of fuel (rather than gallons). So when the price of 100LL reached $6.00 per gallon, I half-jokingly turned to a pilot friend who was flying with me in the right seat and explained that those fuel quantity and fuel flow indications were displayed in dollars and dollars per hour, respectively. (I say half-jokingly, because I was also half-crying.)

When I bought the airplane in 1987, avgas cost around two bucks a gallon, and topping off my twin for a long trip typically cost me around $300 (which seemed bad enough at the time), but today that same top-off costs me $900, which is enough to make me seriously question how long I can continue to do this.

100LL prices in perspective

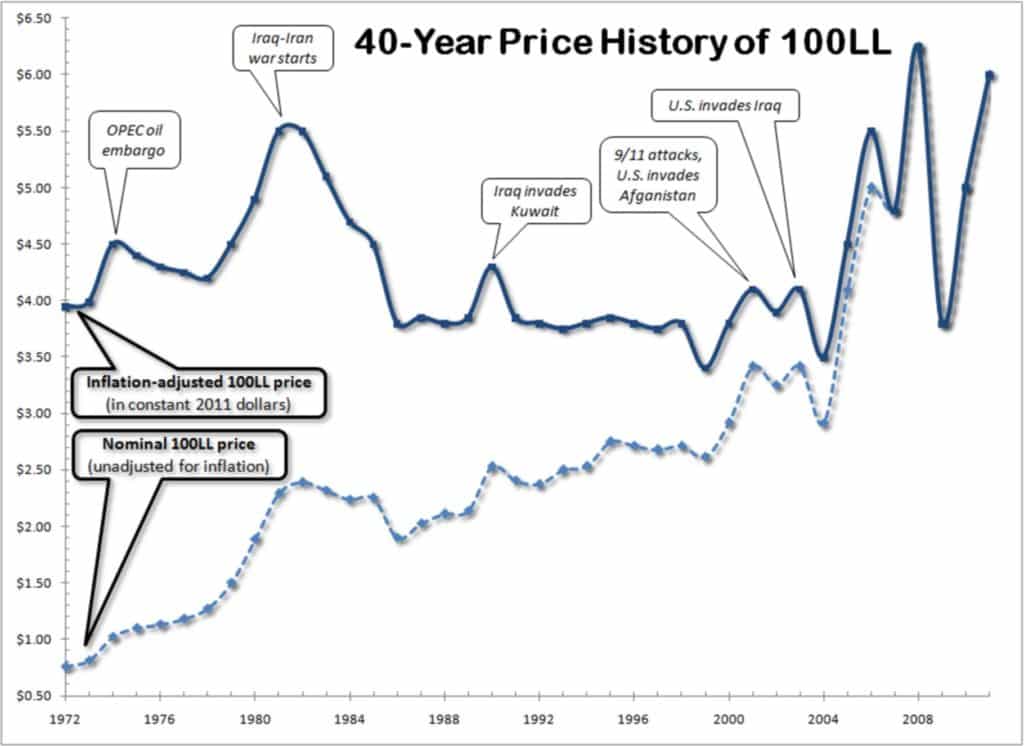

In trying to wrestle with this issue, I spent some time researching fuel prices on the Internet, and what I found out was startling and somewhat counterintuitive. Take a close look at the 40-year history of 100LL prices that I put together in Figure 1.

Pretty interesting: While nominal 100LL prices rose from around 75 cents a gallon in 1972 to the current six bucks a gallon, the real inflation-adjusted price (in today’s dollars) has pretty much remained in a $4 to $6 range over the past four decades. It has hovered around $4/gallon for most of that time, but has had three very obvious spikes up toward $6/gallon: one in the early 1980s (around the time of the Iraq-Iran war), a second in 2008 (just before the housing and stock markets fell off the cliff), and a third that has been developing over the past couple of years. But even at its worst (like now), it appears that peak 100LL prices have only been about 150% of historical norms when viewed in real inflation-adjusted terms.

So while $900 for a fill-up still feels pretty shocking to me, I take some solace in that it’s not quite as shocking as it seems at first blush. Even if fuel prices were down at historical lows (around $4/gallon in today’s dollars), that fillup would still cost around $600.

I’m trying to find some solace in that, although I’m not finding it easy.

Fuel cost multiplier

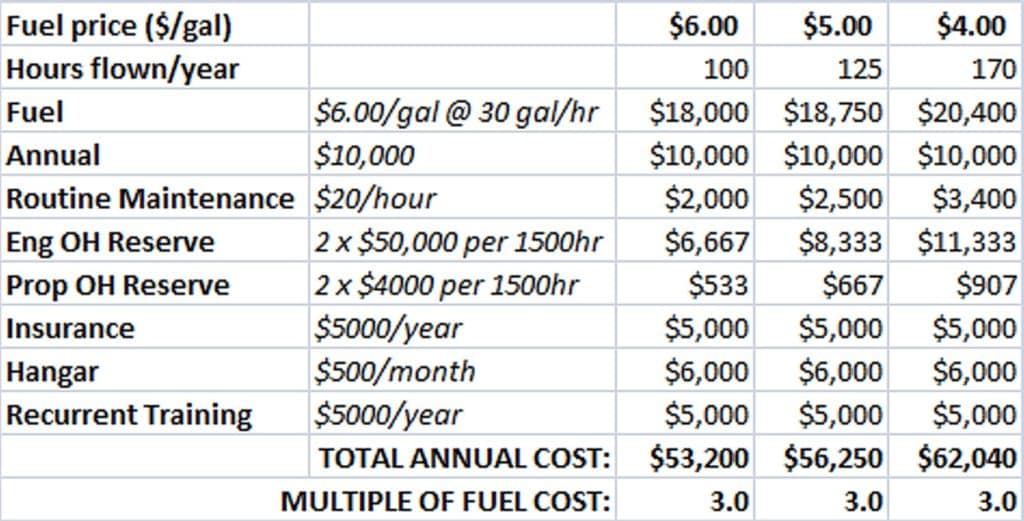

About 20 years ago, some wise aviation guru (I can’t remember who) taught me a useful rule-of-thumb that went something like this: “The total annual cost of aircraft ownership is typically 3 to 4 times the annual cost of fuel, depending on how much the airplane flies each year.” I’ve used that rule-of-thumb many times over the years, and was always amazed at how close it came to being accurate.

Just for giggles, I decided to check again to see if that multiplier would still be accurate today for a piston twin like the one I fly. I thought perhaps it would not, given that 100LL prices in real terms are about 50% higher today then they have been historically.

But halfway through my analysis, it occurred to me that I fly my airplane less when the cost of fuel is high than I do when it is low. That seems like a normal human response—what economists call “price elasticity of demand”—and I rather suspect most other aircraft owners are in the same boat. During most of the time I’ve owned my twin, I’ve flown it between 150 and 200 hours a year. But during times like now when real fuel cost is at historical high levels—and more importantly, feels painful—I’m only flying around 100 hours a year. That means that my fixed costs (like insurance, hangar, and recurrent training) represent a larger portion of my total cost than variable costs (like fuel and oil changes).

I put all this into a spreadsheet (see Figure 2) and it sure looks to me as if the “3 times” rule still holds true.

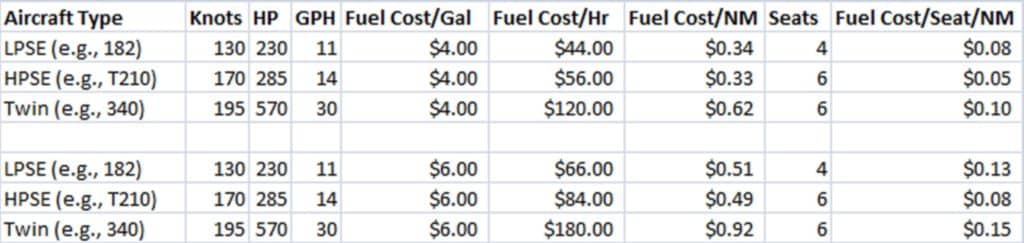

Fuel cost per mile

I also took a quick look at fuel cost per hour, per mile, and per seat-mile for various kinds of piston aircraft (see Figure 3). The only thing that told me is what I already knew: It’s really painful to fly a piston twin in a world of $6/gallon avgas.

Right, Mac? (EAA’s Mac McClellan flies a Baron, which suggests he must be nearly as certifiable as I am.)

Bottom line of all this is that the true impact of $6 avgas is less than I originally thought when put into proper inflation-adjusted context. Yes, it hurts. But no, it doesn’t hurt enough for me to quit flying or sell my airplane.

I feel so much better now.

What if 100LL goes away?

Over the past year or so, there seems to be an awful lot of hysteria in the aviation media and at aviation gatherings about the prospect of 100LL going away altogether, due to EPA and tree-huggers being committed to exterminate anything that puts lead in the atmosphere. While $6 avgas is painful, it sure is a lot better than no avgas at all.

While it’s true that EPA has lowered its threshold of how much atmospheric lead is acceptable by a factor of 10, it is not yet clear exactly what EPA intends to do to enforce the new standard, nor even whether leaded avgas contributes a meaningful amount of lead compared with industrial sources of pollution. (A coalition of GA alphabet groups says that 100LL produces less than 1% of the lead air pollution in the U.S.)

There has been a huge amount of confusing and conflicting information on this subject, and a full treatment would require more pages than EAA has allotted me, not to mention more intelligence and research work than I’m able to muster at the moment.

Although I fly a turbocharged twin that absolutely positively requires nothing less than 100-octane aviation gasoline, I seem to be a lot less worried about the impending disappearance of 100LL than many other aircraft owners I’ve spoken to. Here’s the half-minute version of my thoughts on the subject:

- From what I’ve read, there’s essentially no chance that 100LL will go away before 2017. (By then I’ll be 73 years old and fuel availability will probably be the least of my worries.)

- On September 14, 2011, the FAA issued SAIB NE-11-55 announcing that a specification has been developed for a new grade of aviation gasoline called 100VLL (very low lead), that 100VLL will soon be added to the ASTM 910 specification for avgas, and that 100VLL will be acceptable for use in all engines certified for use on 80, 91, 100 and 100LL fuel. Clearly the purpose of 100VLL is to reduce the time pressure for converting to completely unleaded fuel, increasing the probability that leaded avgas won’t go away by 2017 (we hope).

- There appear to be at least four viable solutions for operating our high-compression and turbocharged piston aircraft engines on unleaded fuel: G100UL, Swift Fuel 102UL, anti-knock electronic ignition (e.g., GAMI’s PRISM system), and water-injection.

- The EPA has gone on record as saying that it doesn’t have the authority to ban 100LL, 100VLL or any other aviation fuel, and that this authority rests with the FAA. The FAA has been pretty clear that they won’t let leaded avgas go away until there’s a viable unleaded successor.

- A coalition of key industry organizations appear united in commitment to develop a transition plan that won’t leave owners stranded—the Future Avgas Strategy and Transition Plan (FAST)

Considering all this, it strikes me as highly improbable that 100LL will be legislated out of existence prior to the time that a viable substitute fuel is available. To be honest, what worries me more is the possibility of a fire, explosion or terrorist attack at the world’s only plant that manufactures tetraethyl lead (Innospec Specialty Chemicals in the U.K.) Now that would be scary.

You bought a plane to fly it, not stress over maintenance.

At Savvy Aviation, we believe you shouldn’t have to navigate the complexities of aircraft maintenance alone. And you definitely shouldn’t be surprised when your shop’s invoice arrives.

Savvy Aviation isn’t a maintenance shop – we empower you with the knowledge and expert consultation you need to be in control of your own maintenance events – so your shop takes directives (not gives them). Whatever your maintenance needs, Savvy has a perfect plan for you: